LEVELAPP TOKEN

CCBROTHER 交易所

A review of the frequency and outcomes of proxy fights against closed-end funds and the potential effects of a proposed New York Stock Exchange rule change to end the requirement to hold annual shareholder meetings. Read more

STICK 交易所

Effective July 1, 2024, the new Securities and Exchange Commission (SEC) rules governing SPAC initial public offerings (IPOs) and deSPAC M&A transactions went into effect. These new rules are designed to enhance disclosures and improve investor protections. Read more

COIN STICK

We have observed a marked increase in IPO filers headquartered in Asia so we took the opportunity to look back ten years to see how things have changed relative to IPO filers headquartered in the US and the change is dramatic. Read more

CRYPTO VENDING MACHINE

The Maryland Unsolicited Takeover Act (MUTA) marks its 25th anniversary on June 1. In honor of the anniversary, we review the current rate of MUTA take-up among Maryland companies. Read more

WOPT EXCHANGE

In April of 2021, as the SPAC market took off, Deal Point Data published its first SPAC Market Study. We recently took the opportunity to revisit the SPAC and de-SPAC market. Read more

LUXALPACHAIN 交易所

With the outcome determined for all but one annual meeting proxy fight for companies subject to the universal proxy card (UPC) rules, we take the opportunity to examine the full-year results of 2023 proxy fights – the first full year under which the UPC rules were in effect. Read more

WINCO LOGIN

Poison pills are back in the news with an increase in litigation surrounding the device, raising the question of what their proper use is. We examine why and for what purpose poison pills are being used. Read more

DATABASEX 交易所

In the latest sign the US IPO market may be emerging from the doldrums, a noteworthy event occurred this month: a public benefit corporation ("PBC") completed an IPO. Sezzle Inc., which has elected to be a public benefit corporation under Delaware law, priced its IPO and began trading on the Nasdaq exchange on August 16th. Sezzle's IPO ends what had been a 21-month drought for IPOs completed by PBCs. Read more

MULTIBRIDGE EXCHANGES

As the M&A regulatory environment has tightened over the last few years, we have seen a significant increase in the inclusion of antitrust termination fees in definitive M&A agreements. An antitrust termination fee is a termination fee potentially payable by the acquirer if the transaction cannot close due to lack of regulatory approval. Essentially, if the deal is blocked by a regulatory agency then the acquirer would be required to pay the antitrust termination fee to the target. Read more

NTIC LOGIN

The IPO market has seen a significant downturn since the SPAC-led highs of 2021. The charts and statistics below bring this downturn into sharp focus and illustrate the poor condition of the US IPO market. Read more

GFAL EXCHANGES

As the M&A regulatory environment has tightened over the last few years, we have seen a significant increase in the inclusion of antitrust termination fees in definitive M&A agreements. An antitrust termination fee is a termination fee potentially payable by the acquirer if the transaction cannot close due to lack of regulatory approval. Essentially, if the deal is blocked by a regulatory agency then the acquirer would be required to pay the antitrust termination fee to the target. Read more

PLEBE GAMING

SPAC deal activity fell sharply in Q1 2022. The number of priced SPAC IPOs dropped from 163 in Q4 2021 to 55 in Q1 2022. Only 34 de-SPAC M&A deals were announced in Q1 compared with 61 in Q4. At the same time the number of withdrawn SPAC deals surged in Q1. Withdrawn SPAC IPOs in Q1 (61) exceeded priced SPAC IPOs (55), and there were 17 withdrawn de-SPAC M&A deals in Q1 vs 28 completed de-SPACs. In addition, there were significant changes involving the use of Termination Fees, PIPE investments, Warrant Coverage, and Acquisition Terms/Durations on SPAC deals in Q1. Read more

ZEARN REFERRAL CODE CRYPTO HACK

In our year-end update we researched SPAC IPO and de-SPAC M&A activity through December 31st. While the number of SPAC IPOs and de-SPAC M&A deals remained relatively robust in Q4 the average size of these deals is dropping. The average size of SPAC IPOs dropped in Q4 for the 3rd consecutive quarter to $176.8 million in average gross proceeds. At the same time the large, mega de-SPAC M&A deals seen in the first 3 quarters were noticeably absent in Q4. No de-SPAC deals announced in Q4 cracked the top 25 all-time largest de-SPACs, resulting in a significant drop in the average size of de-SPAC deals from $2.73B in Q3 to $1.25B in Q4. Read more

DEGENERATOR MEME EXCHANGES

In our 3rd Quarter Update to the initial SPAC Market Study released in April we researched SPAC IPO and de-SPAC M&A activity through September 30th. While it doesn’t look like the torrid pace of SPAC activity in Q1 will return anytime soon, activity did rebound in Q3 to 88 priced SPAC IPOs from 64 in Q2. We also saw many of the largest de-SPAC M&A deals of all time announced in Q3, including MSP Recovery ($32.5B), Polestar ($20B), and Aurora Innovation ($11B). Despite these very large deals being announced, there is still plenty of SPAC dry powder available for more acquisitions in Q4 and into 2022. As of Sept 30th there were 452 SPAC IPOs still seeking a target, representing a total of $115.1B in gross proceeds raised. Read more

FPIS EXCHANGES

In our 2nd Quarter Update to the initial SPAC Market Study released in April we researched SPAC IPO and de-SPAC M&A activity through June 30th. Although increased scrutiny from the SEC certainly decelerated the pace of SPAC deal activity from Q1 to Q2, many of the largest de-SPAC M&A deals of all time were announced in Q2, and the level of activity was still very robust in comparison to previous years. Read more

METAFICIAL WORLD 交易所

Deal Point Data researched every Special Purpose Acquisition Company (SPAC) that filed with the Securities and Exchange Commission from January 1, 2016 to March 31, 2021. We observed these deals throughout the SPAC lifecycle – from registration to IPO pricing to the announcement of a de-SPAC M&A transaction. We reviewed the relevant stock purchase agreements, asset purchase agreements or merger agreements to evaluate key negotiated M&A deal points. Read more

GCC LOGIN

In our research note dated June 24, 2020 we highlighted the increased prevalence of initial public offerings by special purpose acquisition companies (SPACs) as one of the most notable trends in IPOs in the last few years. What we did not discuss at that time is the explosion of SPACs filing to go public, which are at unprecedented levels. Read more

FREQUENCY CRYPTO

The increased prevalence of initial public offerings by special purpose acquisition companies (SPACs) has been one of the most notable trends in IPOs in the last few years. SPACs are blank check companies formed for the purpose of merging with another company following the IPO. Read more

LTNM APP

As a follow up to our recent note regarding companies increasing use of poison pills to guard against opportunist acquirers and activist investors as a result of the coronavirus pandemic (Corporate America's Medicine Against Coronavirus) here are some additional observations: Read more

CRYPTO PLUS

Target companies in agreed fixed exchange stock swap transactions have seen the value of the acquirer's shares they are to receive as consideration in the transaction decrease, in some cases significantly, as the coronavirus pandemic continues to impact stock prices. Read more

QBIC EXCHANGES

Faced with myriad problems caused by the coronavirus pandemic, including significantly depressed stock prices and the ensuing threat of shareholder activism and hostile takeovers, corporate America is turning to an old standby - poison pills. Read more

MICRONFT APP

Given the uncertainty and rising public health concerns around the coronavirus (COVID-19), Deal Point Data decided to take a look at how practitioners are drafting the material adverse change (MAC) definitions in recently announced transactions. Specifically, we wanted to see whether the target MAC definition included a carveout related to the coronavirus and similar concepts. The inclusion of specific carveouts protects the target in the event that the acquirer attempts to terminate the transaction based on a material adverse change. Read more

SER TOKEN BSC EXCHANGES

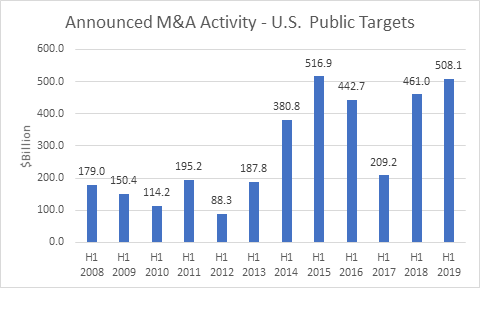

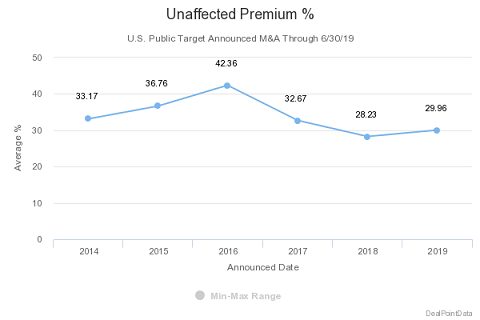

The dollar value of newly announced Merger and Acquisition deals with U.S. publicly traded target companies surged to its highest first half level since the record was set in 2015. According to Deal Point Data’s research, $508 billion dollars of M&A deals were announced during the first six months of 2019. First half activity was only 1.7% below the all-time high and 85% above the 10-year average level. On a year-over-year basis, dollar volume increased 15.1% in June, 4.6% in Q2, and 10.2% for the half year. On a sequential basis, the first half of 2019 was up 94.4% compared to the second half of 2018. In a sign that the market was not overheating, the average unaffected control premium was a moderate 29.96% during the first half, 20.4% below the ten-year average. Goldman, Sachs topped the Deal Point Data investment banking league table for announced U.S. public target deals during the first half advising on $162.3 billion in deals. Wachtell Lipton advised on $142.4 billion in announced deals to earn the number one ranking among legal advisers.

| Target | Acquirer | Equity Value ($bil) |

|---|---|---|

| Celgene Corporation | Bristol-Myers Squibb Company | 71.6 |

| Raytheon Company | United Technologies | 52.0 |

| Anadarko Petroleum | Occidental Petroleum | 37.9 |

| Worldpay, Inc. | Fidelity National Information Services | 34.8 |

| SunTrust Banks | BB&T Corporation | 28.2 |

BITCOIN SCAMMER LIST WHATSAPP

Wachtell, Lipton, Rosen & Katz was the top ranked legal adviser on U.S. public M&A deals announced during the first half of 2019. Wachtell advised on 14 public deals valued at $249.4 billion. Kirkland & Ellis ranked second in the high-profile public M&A advisory market while Skadden rounded out the top three.

| Rank | Firm | Equity Value ($bil) |

|---|---|---|

| 1 | Wachtell, Lipton, Rosen & Katz | 249.4 |

| 2 | Kirkland & Ellis | 100.8 |

| 3 | Skadden | 88.4 |

HABIBI LOGIN

As of July 1, 2019, record M&A advisory fees of $2.03 billion have already been disclosed on U.S. public deals announced during the first half of 2019. Goldman led the market with $447 million in fees disclosed. JP Morgan took second place among financial advisers. Morgan Stanley rounded out the top three in disclosed fees.

SIN EXCHANGES

Filing: On November 8, 2024, the Board of Directors of the Company approved and adopted amended and restated bylaws of the Company (as so amended and restated, the "Amended and Restated Bylaws"), effective as of such date. Among other things, the amendments effected by the Amended and Restated Bylaws reflec ... (10-Q )

Filing: On November 12, 2024, the Company amended and restated its bylaws to make certain updates and revisions (the "Amended and Restated Bylaws"). Among other matters, the amendments contained in the Amended and Restated Bylaws: i.revise the procedures for adjournments of stockholder, annual and special m ... (8-K )

Exhibit: Charter Amended/Restated Effective 08/12/2021 (10-Q )

DPD Note: Elliott Investment Management began a campaign at Honeywell International urging the board to separate the company into two independently traded public entities arguing the conglomerate structure is adversely affecting shareholder value (Press Release )

Exhibit: Bylaws Amended/Restated Effective 08/13/2024 (10-Q )

Exhibit: Charter Amended/Restated Effective 08/29/2024 (10-Q )

Filing: As previously reported, at the annual meeting of shareholders of P.A.M. Transportation Services, Inc. (the "Company") held on October 31, 2024 (the "Annual Meeting"), the Company's shareholders approved the proposed change of the Company's state of incorporation from Delaware to Nevada (the "Redomes ... (8-K )

Filing: As previously reported, at the annual meeting of shareholders of P.A.M. Transportation Services, Inc. (the "Company") held on October 31, 2024 (the "Annual Meeting"), the Company's shareholders approved the proposed change of the Company's state of incorporation from Delaware to Nevada (the "Redomes ... (8-K )

Exhibit: Charter Amended/Restated Effective 11/08/2024 (8-K12G3/A )

Exhibit: Bylaws Amended/Restated Effective 11/08/2024 (8-K12G3/A )

Filing: On November 8, 2024, the Board of Directors ("the Board") of Silver Star Properties REIT, Inc. (the "Company") authorized, and the Company declared, a dividend of one preferred share purchase right (a "Right") for each outstanding share of common stock par value $0.001 per share, of the Company (the ... (8-K )

DPD Note: The company has scheduled its 2025 annual meeting for March 12, 2025 and provided a deadline of November 22, 2024 to submit a proposal or director nomination at the meeting. As part of company's reincorporation in Ireland from Switzerland on September 30, 2024, the company's Irish Articles of Association became effective which established new advance notice timeliness requirements. The company had not previously provided updated advance notice deadlines in connection with the change. (8-K )

Filing: On November 8, 2024, the Board of Directors approved and adopted Revised and Restated By-Laws (the "Restated By-Laws"), which became effective immediately. Among other things, the amendments: (a) enhance the procedural mechanics and disclosure requirements relating to business proposals submitted an ... (10-Q )

DPD Note: The company's enhanced director voting provision expired on November 10, 2024 in accordance with a sunset provision in the charter. Holders of Class A Common Stock, exclusively and as a separate class, had been entitled to appoint or elect the majority of directors. The company's enhanced director voting provision had been subject to a sunset and was in effect only for a period of ten years from the date of the first issuance of shares of Class A Common Stock (November 10, 2014). (Deal Point Data Research )

Filing: The Board of Directors (the "Board") of Artesian Resources Corporation (the "Company") approved amendments to the Company's By-laws (as amended and restated, the "By-laws"), which became effective on November 4, 2024. The amendments to the By-laws were focused on updating definitions relating to the ... (10-Q )

Filing: On November 5, 2024, the board of directors of Cadre Holdings, Inc. (the "Company") approved and adopted the Second Amended and Restated Bylaws of the Company (the "Second Amended and Restated Bylaws"), which became effective immediately upon such approval and adoption. The Second Amended and Restat ... (8-K )

DPD Note: The 2024 annual meeting has been scheduled for December 19, 2024 which is more than 30 days later then the anniversary of the 2023 annual meeting held on June 14, 2023 triggering the alternative timing provision in the company's advance notice bylaw and a new deadline under Rule 14a-8. The company provided a new deadline of November 18, 2024 for all proposals and nominations. (8-K )

DPD Note: Tang Capital Management began a campaign at ESSA Pharma with an initial 13D filing reporting the shares were purchased for investment purposes and that it may seek discussions with management on a potential acquisition proposal (SC 13D )

Filing: On November 7, 2024 the Company filed a Certificate of Retirement with the Secretary of State of the State of Delaware to retire 2,520 shares of LT50 common stock, par value $0.0001 per share, of the Company ("LT50 Common Stock"). All 2,520 shares of LT50 Common Stock were converted into 2,520 share ... (10-Q )

Exhibit: Charter Amended/Restated Effective 11/15/2021 (10-Q )

DPD Note: 10-Q filing provides corrected deadlines to submit nominations for the 2025 annual meeting. The proxy statement for the 2024 annual meeting provided incorrect dates. The correct window is between February 3, 2025 and March 5, 2025. (10-Q )

Exhibit: Bylaws Amended/Restated Effective 07/31/2024 (10-Q )

DPD Note: National Legal and Policy Center (NLPC) filed a Notice of Exempt Solicitation on a voluntary basis urging stockholders to vote against the re-election of director Reid Hoffman at the company's December 10, 2024 annual meeting. NLPC cited among other issues, Mr. Hoffman's poor judgment, political activism and affiliation with deceptive and unethical organizations, that could risk alienating a significant number of the firm's customers. (PX14A6G )

DPD Note: Q Global Capital Management began a campaign at ModivCare with an initial 13D reporting that it expects to continue discussions with the board regarding the recent commitments made by the company, which have yet to be completed (SC 13D )

DPD Note: As You Sow filed a Notice of Exempt Solicitation on a voluntary basis in support of a stockholder proposal requesting the company publish a report disclosing how it is protecting plan from increased future portfolio risk created by present-day investments in high-carbon companies. The proposal was submitted by As You Sow on behalf of Frances L. Bell T/W fbo Patrick de Freitas and Roy A. Hunt Foundation, and will be voted on at the company's December 10, 2024 annual meeting. (PX14A6G )

Filing: Upon consummation of the Transaction, the certificate of incorporation and bylaws of the Company were amended and restated in their entirety. As a consequence of the amendment and restatement of the certificate of incorporation and bylaws of the Company, the rights of the holders of Primo Shares wer ... (8-K12G3 )

Filing: Upon consummation of the Transaction, the certificate of incorporation and bylaws of the Company were amended and restated in their entirety. As a consequence of the amendment and restatement of the certificate of incorporation and bylaws of the Company, the rights of the holders of Primo Shares wer ... (8-K12G3 )

DPD Note: Reincorporation in Delaware from Ontario, Canada in connection with the company's (Primo Water Corporation) merger of equals with an affiliate of BlueTriton Brands, Inc., creating Primo Brands Corporation. (8-K12G3 )

Filing: On November 8, 2024, the Board of Directors (the "Board") of Southside Bancshares, Inc. (the "Company") adopted an Amendment (the "Amendment") to the Amended and Restated Bylaws of the Company (the "Bylaws"), effective immediately. The Amendment adds a new Section 3.08 to the Bylaws, which provides ... (8-K )

DPD Note: The company entered into a Support Agreement with Nitor Capital Management, LLC under which Eric Speron will be appointed to the Board. Nitor will maintain certain replacement rights with respect to the Board seat. The agreement includes standstill and voting commitments. Nitor had previously publicly criticized the company's financial performance and called for a vote against the reelection of the four leadership level directors at the May 2024 annual meeting. (8-K )

DPD Note: The company has scheduled the 2024 annual meeting for December 30, 2024 which will be held in the event the company's merger with UnitedHealth Group Incorporated has not been completed. If the merger closes before December 30, 2024, the Board will cancel the annual meeting. The meeting date will be more than 60 days later than the anniversary of the company's 2023 annual meeting held on June 8, 2023 triggering the alternative timing provision in the company's advance notice bylaw and a new deadline under Rule 14a-8. The company provided a new 14a-8 deadline of November 18, 2024 and non-14a-8 proposals and nominations deadline of November 17, 2024. (10-Q )

Exhibit: Charter Amended/Restated Effective 09/09/2021 (10-Q )

DPD Note: Vote results for November 6, 2024 annual meeting include a stockholder proposal to prohibit the re-nomination of any director who fails to receive a majority vote that failed to receive a majority of votes cast and was not approved. (8-K )

Exhibit: Charter Amended/Restated Effective 10/30/2009 (10-Q )

Filing: Effective as of November 4, 2024, the Board of Directors of Co-Diagnostics, Inc. (the "Company"), approved an amendment (the "Amendment") to the Company's Amended and Restated Bylaws (the "Bylaws"). The Amendment modifies the Company's Bylaws to eliminate the classification of the Board of Directors ... (10-Q )

Filing: On November 5, 2024, the Board of Directors of Ducommun Incorporated (the "Company") amended and restated its bylaws (as so amended and restated, the "Bylaws") to change the authorized number of directors to be not less than six (6) nor more than ten (10) until changed by an amendment to such Bylaws ... (8-K )

Filing: Elicio Therapeutics, Inc. (the "Company") convened a virtual annual meeting of stockholders (the "Annual Meeting") on Thursday, November 7, 2024, at 9:30 a.m., Eastern Time. The Annual Meeting was adjourned under Section 2.8 of the Amended and Restated Bylaws of the Company because a quorum of the h ... (8-K )

DPD Note: At the November 6, 2024 special meeting, a majority of the votes cast were against the approval on an advisory basis of certain compensation that may become payable to the company's named executive officers in connection with the transactions contemplated by the Merger Agreement ("say on parachute" vote). (8-K )

Exhibit: Bylaws Amended/Restated Effective 09/25/2024 (10-Q )

Filing: As previously disclosed, at a special meeting of stockholders held on October 31, 2024, the stockholders of FuelCell Energy, Inc. (the "Company") adopted an amendment (the "Reverse Stock Split Amendment") to the Company's Certificate of Incorporation, as amended (the "Certificate of Incorporation"), ... (8-K )

Exhibit: Poison Pill Adoption Effective 11/06/2024

Press release: Greenfire Resources Ltd. Files Injunction Following Cease Trade of Rights Plan; Proceeds with Strategic Review and Adopts New Shareholder Rights Plan (6-K )

DPD Note: The company announced plans to solicit stockholder approval at the company's 2025 annual meeting to eliminate the company's classified Board structure and consider the resignation of any director who does not receive a majority vote in uncontested elections (the company currently has a plurality vote standard). (Press Release )

Exhibit: Charter Amended/Restated Effective 01/26/2017 (10-Q )

Filing: On November 5, 2024, the Board amended the Company's Bylaws, effective immediately, to eliminate an outdated reference to Section 162(m) of the Internal Revenue Code (the "Code"). The Bylaws contained a provision that allowed the Company to exclude a "proxy access" shareholder nominee for election a ... (10-Q )

Exhibit: Charter Amended/Restated Effective 05/13/1987 (10-Q )

Filing: On November 5, 2024, the Company's Board of Directors approved and adopted amendments to the Company's second amended and restated bylaws (as amended, the "Amended and Restated Bylaws"), which became effective the same day. Among other things, the amendments contained in the Amended and Restated Byl ... (10-Q )

Exhibit: Bylaws Amended/Restated Effective 08/14/2024 (10-Q )

Filing: On November 6, 2024, the Board approved and adopted the Fourth Amended and Restated By-laws of the Company (the "By-laws"), effective the same day. The By-laws reflect the adoption of a majority voting standard for the election of director nominees, with a plurality vote standard retained for contes ... (8-K )

Exhibit: Charter Amended/Restated Effective 07/23/1996 (10-Q )

Filing: On November 6, 2024, the Company's Board of Directors (the "Board") approved and adopted a Third Amended and Restated Bylaws of the Company amending and restating the Company's Second Amended and Restated Bylaws (as amended and restated, the "Bylaws") to (i) align the Bylaws with the Securities and ... (10-Q )

Filing: Our board of directors approved the Company's Third Amended and Restated Bylaws (the "Third Amended and Restated Bylaws"), effective November 7, 2024. The Third Amended and Restated Bylaws incorporate certain amendments to, among other things: (i) permit only our board of directors to call a special ... (10-Q )

Exhibit: Bylaws Amended/Restated Effective 08/13/2024 (10-Q )

Filing: On November 6, 2024, the Company Board approved and adopted an amendment (the "Bylaw Amendment") to the Company's Second Amended and Restated Bylaws (the "Bylaws "), to add a new Article XIV that provides that the Circuit Court for Baltimore City, Maryland, or, if that Court does not have jurisdicti ... (8-K )

Filing: On November 6, 2024, the Board of Directors of Roper Technologies, Inc. (the "Company") amended the Company's Amended and Restated By-Laws (as so amended, the "By-Laws") to amend Article 12, Amendments, to reduce the ownership threshold necessary for shareholders to amend the By-Laws at any meeting ... (8-K )

Filing: Effective November 4, 2024, the Company's Board of Directors (the "Board") amended and restated the Company's Amended and Restated By-laws (as amended and restated, the "Bylaws") primarily to clarify and implement certain procedural and disclosure requirements for the Company's stockholders proposin ... (10-Q )

Exhibit: Charter Amended/Restated Effective 08/26/2024 (10-Q )

Filing: On November 7, 2024, the board of directors of Tractor Supply Company amended the Sixth Amended and Restated By-laws for the Company (the "By-laws"), effective immediately, to adopt new Article XIII providing that, unless the Company consents to an alternative forum, the Delaware Court of Chancery ( ... (10-Q )

DPD Note: 2025 annual meeting "expected to be held" on March 6, 2025. (10-K )

Exhibit: Bylaws Amended/Restated Effective 08/06/2024 (10-Q )

DPD Note: Juniper Investment Company began a campaign at Allient Inc with an initial 13D filing reporting it expects to continue discussions with management and the board on a broad range of matters relevant to its investment in the enterprise (SC 13D )

Press release: bluebird bio Adjourns Meeting of Stockholders and Announces Third Quarter Results Call (8-K )

Filing: On November 5, 2024, LegalZoom's Board of Directors (the "Board") approved and adopted an amendment and restatement of LegalZoom's bylaws (as so amended and restated, the "Bylaws"), which became effective immediately upon approval. The Bylaws reflect, among other things, the following principal chan ... (8-K )

Filing: On October 31, 2024, the Board approved and adopted a second amendment to our Fifth Amended and Restated Bylaws (Second Amendment), effective immediately, to permit special meetings of the Board to be called by the Chairman of the Board, the Chief Executive Officer, the Lead Independent Director or ... (10-Q )

ORME EXCHANGE

Smart Digital Group Limited filed for an initial public offering with its filing of an F-1 with the Securities and Exchange Commission (SEC)

Smart Digital Group Limited disclosed plans to offer 1,500,000 ordinary shares in its IPO

Smart Digital Group Limited set the anticipated price range for its IPO at between $4.00 and $6.00 per share

Metros Development Co., Ltd. decreased the number of shares to be offered to 1,333,334 shares from 2,500,000 shares

FPA Energy Acquisition Corp. filed for an initial public offering with its filing of an S-1 with the Securities and Exchange Commission (SEC)

FPA Energy Acquisition Corp. disclosed plans to offer 10,000,000 units, with each unit consisting of one share of common stock and 1/10 of one right to purchase one share of common stock

The underwriters received a discount of $0.20 per share (a gross spread of 2%) and a total of $2 mil for underwriting FPA Energy Acquisition Corp.'s IPO

FPA Energy Acquisition Corp. disclosed that the offer price for the units issued in its initial public offering will be $10.00 per unit

MasterBeef Group filed for an initial public offering with its filing of an F-1 with the Securities and Exchange Commission (SEC)

GLAMOORE Capital Group Company Limited filed for an initial public offering with its filing of an F-1 with the Securities and Exchange Commission (SEC)

GLAMOORE Capital Group Company Limited disclosed plans to offer 2,000,000 ordinary shares in its IPO

GLAMOORE Capital Group Company Limited set the anticipated price for its IPO at $4.00 per share

KNOREX LTD. filed for an initial public offering with its filing of an F-1 with the Securities and Exchange Commission (SEC)

KNOREX LTD. disclosed plans to offer 2,500,000 Class A ordinary shares in its IPO

KNOREX LTD. set the anticipated price range for its IPO at between $4.00 and $5.50 per ADS

Invizyne Technologies Inc.'s registration statement was declared effective by the Securities and Exchange Commission (SEC)

JFB Construction Holdings filed for an initial public offering with its filing of an S-1 with the Securities and Exchange Commission (SEC)

JFB Construction Holdings disclosed plans to offer 1,250,000 units, with each unit consisting of one Class A ordinary share and one warrant

JFB Construction Holdings set the anticipated price for its IPO at $4.125 per share

Flagfish Acquisition Corporation filed for an initial public offering with its filing of an S-1 with the Securities and Exchange Commission (SEC)

Flagfish Acquisition Corporation disclosed plans to offer 6,000,000 units, with each unit consisting of one ordinary share and one right to purchase 1/10 of one share

The underwriters received a discount of $0.45 per share (a gross spread of 5.5%) and a total of $2.7 mil for underwriting Flagfish Acquisition Corporation's IPO

Flagfish Acquisition Corporation disclosed that the offer price for the units issued in its initial public offering will be $10.00 per unit

Hennessy Capital Investment Corp. VII filed for an initial public offering with its filing of an S-1 with the Securities and Exchange Commission (SEC)

Hennessy Capital Investment Corp. VII disclosed plans to offer 15,000,000 units, with each unit consisting of one Class A ordinary share and one right to receive 1/15 of one share

The underwriters received a discount of $0.60 per share (a gross spread of 6%) and a total of $8 mil for underwriting Hennessy Capital Investment Corp. VII's IPO

Hennessy Capital Investment Corp. VII disclosed that the offer price for the units issued in its initial public offering will be $10.00 per unit

The SEC filed a staff letter indicating that the registration statement related to this IPO be declared abandoned given that the registration statement has been on file for more than nine months and has not yet become effective

Apimeds Pharmaceuticals US, Inc. disclosed plans to offer 3,333,334 shares of common stock in its IPO

Apimeds Pharmaceuticals US, Inc. set the anticipated price range for its IPO at between $3.00 and $4.00 per share

Willow Lane Acquisition Corp.'s registration statement was declared effective by the Securities and Exchange Commission (SEC)

A SPAC III Acquisition Corp.'s registration statement was declared effective by the Securities and Exchange Commission (SEC)

Masonglory Limited filed for an initial public offering with its filing of an F-1 with the Securities and Exchange

Masonglory Limited disclosed plans to offer 1,500,000 ordinary shares to the public in its IPO

Masonglory Limited set the anticipated price range for its IPO at between $4.00 and $6.00 per share

Navios South American Logistics Inc. withdrew its initial public offering

Drugs Made In America Acquisition Corp. decreased the number of units to be offered to 20,000,000 units from 50,000,000 units, and each unit now consists of one share and 1/8 of one right

Drugs Made In America Acquisition Corp. disclosed that the underwriting discount is now $0.35 per unit (a gross spread of 3.5%), or $7,000,000, previously the company disclosed a discount of $0.30 per unit

BRB Foods Inc. decreased the anticipated price range for its IPO to between $4.25 and $4.75 per share from between $4.00 and $5.00 per share

GSR III Acquisition Corp.'s registration statement was declared effective by the Securities and Exchange Commission (SEC)

Artius II Acquisition Inc. filed for an initial public offering with its filing of an S-1 with the Securities and Exchange Commission (SEC)

Artius II Acquisition Inc. disclosed plans to offer 20,000,000 units, with each unit consisting of one Class A ordinary share, one right to receive 1/10 of one share, and one contingent right

The underwriters received a discount of $0.575 per unit (a gross spread of 5.75%) and a total of $11.5 mil for underwriting Artius II Acquisition Inc.'s IPO

Artius II Acquisition Inc. disclosed that the offer price for the units issued in its initial public offering will be $10.00 per unit

AgiiPlus Inc. withdrew its initial public offering after determining not to pursue its IPO at this time

RedCloud Holdings plc filed for an initial public offering with its filing of an F-1 with the Securities and Exchange Commission (SEC)

Skycorp Solar Group Limited filed for an initial public offering with its filing of an F-1 with the Securities and Exchange

Skycorp Solar Group Limited disclosed plans to offer 2,700,000 ordinary shares to the public in its IPO

Skycorp Solar Group Limited set the anticipated price range for its IPO at between $4.00 and $5.00 per share

Fuxing China Group Limited disclosed that the offering would now consist of 1,500,000 ADS, with each ADS representing 15 ordinary shares, previously the company had disclosed an offering of 1,000,000 ADS with each ADS representing 20 ordinary shares

The SEC filed a staff letter indicating that the registration statement related to this IPO be declared abandoned given that the registration statement has been on file for more than nine months and has not yet become effective

OMS Energy Technologies Inc. filed for an initial public offering with its filing of an F-1 with the Securities and Exchange Commission (SEC)

FBS Global Limited withdrew its initial public offering after determining not to pursue its IPO at this time

Mega Fortune Company Limited filed for an initial public offering with its filing of an F-1 with the Securities and Exchange Commission (SEC)

Mega Fortune Company Limited disclosed plans to offer 3,750,000 ordinary shares to the public in its IPO

Mega Fortune Company Limited set the anticipated price range for its IPO at between $4.00 and $5.00 per ordinary share

Basel Medical Group Ltd disclosed plans to offer 2,500,000 ordinary shares to the public in its IPO

Basel Medical Group Ltd set the anticipated price range for its IPO at between $4.00 and $5.00 per ordinary share

Cantor Equity Partners I, Inc. filed for an initial public offering with its filing of an S-1 with the Securities and Exchange Commission (SEC)

Cantor Equity Partners I, Inc. disclosed plans to offer 20,000,000 Class A ordinary shares in its IPO

The underwriters received a discount of $0.20 per unit (a gross spread of 2%) and a total of $4 mil for underwriting Cantor Equity Partners I, Inc.'s IPO

Cantor Equity Partners I, Inc. disclosed that the offer price for the shares issued in its initial public offering will be $10.00 per share

The shareholders of FreeCast, Inc. increased the offering to 17,518,270 shares from a plan to resell 14,846,977 shares of common stock in the direct listing

Bleichroeder Acquisition Corp. I.'s registration statement was declared effective by the Securities and Exchange Commission (SEC)

Newbury Street II Acquisition Corp's registration statement was declared effective by the Securities and Exchange Commission (SEC)

PicoCELA Inc. filed for an initial public offering with its filing of an F-1 with the Securities and Exchange Commission (SEC)

PicoCELA Inc. disclosed plans to offer 2,000,000 American Depositary Shares (ADS) with each ADS representing 1 share of common stock

PicoCELA Inc. set the anticipated price range for its IPO at $4.00 to $6.00 per ADS

K&F Growth Acquisition Corp. II filed for an initial public offering with its filing of an S-1 with the Securities and Exchange Commission (SEC)

K&F Growth Acquisition Corp. II disclosed plans to offer 25,000,000 units, with each unit consisting of one Class A ordinary share and 1/15 of one right to purchase one share

The underwriters received a discount of $0.55 per unit (a gross spread of 5.5%) and a total of $13.75 mil for underwriting K&F Growth Acquisition Corp. II's IPO

K&F Growth Acquisition Corp. II disclosed that the offer price for the units issued in its initial public offering will be $10.00 per unit

Medicus Pharma Inc. increased the number of units to be offered to 880,000 units from 555,000 units

The GrowHub Limited filed for an initial public offering with its filing of an F-1 with the Securities and Exchange Commission (SEC)

The GrowHub Limited disclosed plans to offer 2,725,000 Class A ordinary shares to the public in its IPO

The GrowHub Limited set the anticipated price range for its IPO at between $4.00 and $5.00 per Class A ordinary share

Republic Power Group Limited withdrew its initial public offering after determining not to pursue its IPO at this time

LZ Technology Holdings Limited decreased the number of Class B ordinary shares to be offered to 1,500,000 shares from 10,000,000 shares

Archimedes Tech SPAC Partners II Co. filed for an initial public offering with its filing of an S-1 with the Securities and Exchange Commission (SEC)

Archimedes Tech SPAC Partners II Co. disclosed plans to offer 20,000,000 units, with each unit consisting of one ordinary share and one-half of one warrant

The underwriters received a discount of $0.55 per unit (a gross spread of 5.5%) and a total of $11 mil for underwriting Archimedes Tech SPAC Partners II Co.'s IPO

Archimedes Tech SPAC Partners II Co. disclosed that the offer price for the units issued in its initial public offering will be $10.00 per unit

Polyrizon Ltd. increased the number of units to be offered to 958,903 units from 807,692 units

The underwriters received a discount of $0.35 per unit (a gross spread of 8%) and a total of $336,000 for underwriting Polyrizon Ltd.'s IPO

Polyrizon Ltd. set the price of its initial public offering of 958,903 units at $4.38 per share, at the low end of the anticipated price range, for gross proceeds of approximately $4.2 mil

Tavia Acquisition Corp. decreased the number of units to be offered to 10,000,000 units from 17,500,000 units, each unit now consists of one ordinary share and one-half of one warrant

Medicus Pharma Inc. increased the number of units to be offered to 555,000 units from 500,000 units

Callan JMB Inc. filed for an initial public offering with its filing of an S-1 with the Securities and Exchange Commission (SEC)

Callan JMB Inc. disclosed plans to offer 1,280,000 shares of common stock in its IPO

Callan JMB Inc. set the anticipated price range for its IPO at between $4.00 and $6.00 per share

Hong Kong Pharma Digital Technology Holdings Ltd filed for an initial public offering with its filing of an F-1 with the Securities and Exchange Commission (SEC)

Hong Kong Pharma Digital Technology Holdings Ltd disclosed plans to offer 1,500,000 ordinary shares in its IPO, with the company offering 1,000,000 shares and selling shareholders offering 500,000 shares

Hong Kong Pharma Digital Technology Holdings Ltd set the anticipated price range for its IPO at between $4.00 and $6.00 per ordinary share

Transten Global Group Limited filed for an initial public offering with its filing of an F-1 with the Securities and Exchange Commission (SEC)

The SEC filed a staff letter indicating that the registration statement related to this IPO be declared abandoned given that the registration statement has been on file for more than nine months and has not yet become effective

Gelteq Limited's registration statement was declared effective by the Securities and Exchange Commission (SEC)

Polyrizon Ltd.'s registration statement was declared effective by the Securities and Exchange Commission (SEC)

Advanced Biomed Inc. decreased the number of shares to be offered to 1,875,000 shares from 25,000,000 shares

Advanced Biomed Inc. increased the anticipated price range for its IPO to between $4.00 and $6.00 per share from a range of $4.00 to $5.00 per share

The SEC filed a staff letter indicating that the registration statement related to this IPO be declared abandoned given that the registration statement has been on file for more than nine months and has not yet become effective

CAN YOU SEND CRYPTO ON CRYPTO.COM

The 2023 proxy season is ramping up. Here’s an early look at the numbers and emerging trends. Read more

Lawyers have been recommending U.S. reporting companies update their bylaws in response to the universal proxy card rules now in effect. Judging by the record number of bylaw changes filed in November, companies are heeding this advice. Read more

ESG-focused activists are increasingly using exempt solicitation filings to get their message out, and in recent years have increasingly shifted their focus toward environmental and social issues (E&S) while also escalating the pressure on subject companies. Read more

The debate over dual class share structures has been ongoing for over a century. Yet every few years, dual class structures come under increased scrutiny and criticism – usually triggered by a specific event, such as a high-profile company going public with the founder retaining a class of supervoting shares – then the increased attention fades away. Recent policy changes by proxy advisory firms begin to take effect this year, and it will be interesting to watch this proxy season and next to see if the escalated pressure on companies with dual class structures will have any material effect. Read more

Deal Point Data continuously monitors changes to corporate charters and bylaws and other announcements for key governance and takeover defense changes as part of our ESG research. After a unique year in which the Covid-19 pandemic upended several long term trends, 2021 largely reverted back to what we had been observing in recent years - less companies making structural takeover defense changes, lower overall governing document filings and amendments, and less poison pill activity. Read more

One year removed from the Covid-19 related stock market crash and the resulting increase in the number of companies turning to poison pills, we revisit the status of these companies and plans. Read more

Companies that delayed the holding of their 2020 annual meeting that are returning to their traditional annual meeting schedule may be impacting advance notice deadlines for proposals and director nominations. A review of advance notice provisions and a feature that can require a resetting of the submission deadlines. Read more

Deal Point Data continuously tracks changes to corporate charters and bylaws for key governance and takeover defense changes. The public health impact of the COVID-19 pandemic led to an increase in changes to governing documents in 2020 including numerous companies making the changes necessary to facilitate virtual shareholder meetings. Read more

A review of charter and bylaw filings in the six months since the Delaware Supreme Court upheld federal forum provisions ("FFP") shows that FFPs are becoming standard in the governing documents of IPO companies and among existing companies, an initial spike of adoptions that has steadily leveled off. gate io app

Deal Point Data continuously tracks changes to corporate charters and bylaws for key governance and takeover defense changes. With much of the conversation surrounding corporate governance shifting away from shareholder rights to social and environmental issues, the volume of defense changes and updates to governing documents in general declined for companies of all sizes for a second year in a row. Read more

A review of Deal Point Data defense change and disclosure data for S&P 1500 companies in 2018 yields a few observations including governance best practices adopted by large cap companies continuing to trickle down to smaller companies, companies of all sizes are concerned with stockholder lawsuits, and absent traditional structural defenses, large cap companies are focusing on bylaw language, with very limited participation by stockholders. Read more

It’s hard to believe that the votes associated with what was once the most controversial item in the corporate governance landscape have become downright routine. Since January 1, 2017, 74 out of the 75 company proposals to approve a poison pill (aka a shareholder rights plan) passed and the lone proposal that was voted down comes with an asterisk because it was not a typical vote. Read more

Governance activists waged a hard-fought battle to establish proxy access at public companies and ultimately succeeded as proxy access has been widely adopted. It is therefore rather surprising that we have yet to have a proxy access nomination go to an actual vote. If it is going to happen in the 2019 proxy season, we’re likely to know soon as we’ve entered the part of the calendar where proxy access notice windows are opening. Read more

0X NUMBER CRYPTO

ZEROPAY FINANCE EXCHANGE

The first half of 2019 saw the début of 83 companies listing on U.S. stock exchanges through initial public offerings. The companies raised $34.3 billion a 9.4% decrease over the first six months of 2018. These statistics exclude Special Purpose Acquisition companies. Included in this cohort where 10 “Unicorns”, private companies, such as Uber, with pre-IPO valuations of at least one billion. According to Deal Point Data, this is the most Unicorn issues since IPO records began in 1980. Morgan Stanley topped the Deal Point Data U.S. IPO underwriting league table for the first half of 2019. Cooley was the number one ranked legal counsel to issuers while Davis Polk was the leading counsel to underwriters.

SCHWAB CRYPTO ETF

The dollar value of new issues of SEC registered high-yield bonds fell by 46.8% to $16.2 billion during the first six months of 2019 on a year-over-year basis. On a sequential basis, the dollar value increased by 62.6% compared to the dismal second half of 2018..